Articles

- citizenship professionals – Leo Vegas casino bonus

- Happy Charmer put bonus one hundred gopher silver gambling establishment position

- Rescue Thousands of dollars and you can Days Applying this For Your business

- Social Defense Benefits

- Ideas on how to Contour the brand new Expatriation Income tax when you are a shielded Expatriate

- Utility – Have you got a disconnect notice or perhaps is your own utility bill thirty days or higher delinquent?

Unlock a Santander Find Bank account on the coupon code one to are revealed when you go into your own email address (you must go into your first and you may last identity as well as a keen email, this may be shows another code). You will find a monthly solution charges to your each other profile which can be waived for many who satisfy the requirements. On the ONB Common Checking account, it is waived if you have an excellent $5,100000 daily balance or manage a good $twenty five,one hundred thousand joint minimum everyday equilibrium certainly your put account.

If your fiduciary is stating the institution Availableness Income tax Borrowing from the bank, don’t range from the count always assess the credit to your line 1a. Install a statement list the name and you may target of every charitable organization to which your own contributions totaled $3,one hundred thousand or more. California laws basically pursue federal legislation, however, California cannot follow IRC Section 1202.

With this processes Leo Vegas casino bonus , you have the right to act, present the circumstances, and you will look for legal let when needed. Asking a tenant to vacate the property isn’t usually the most basic section of are a property owner. Possibly terminating the new rent is perfect for each other property manager and you may t…

- Multiyear compensation try settlement that is found in your income inside 1 taxation year but that’s owing to a time you to definitely boasts a couple of income tax ages.

- Reference the newest Court Observes part to find out more.

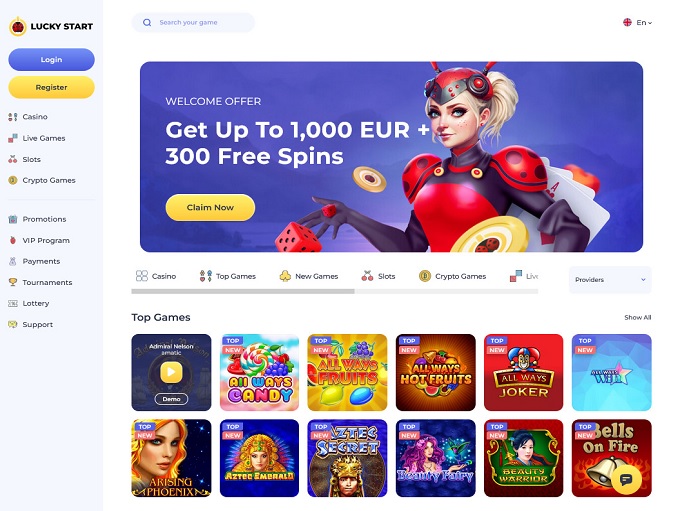

- Ruby Chance is actually a mature online casino, giving up an informal a hundred% suits incentive all the way to NZ$step one,100.

- If you’lso are a property manager seeking to lose citizen move-inside the will cost you and you will clarify the protection put collection processes, Qira may help.

- For the December twelve, 2024, Lola stumbled on the us to have trips and you can gone back to Malta to the December 16, 2024.

- Suits bonuses or put match bonuses tend to match your $5 put gambling enterprise finest-around a specific the amount, normally during the fifty% otherwise one hundred%, even though almost every other rates can get pertain.

citizenship professionals – Leo Vegas casino bonus

With so many different types of online casino bonuses, sometimes it is hard to define what can an ideal you to… Also is the fact most of these gambling establishment headings provides for example lower bet brands depending on for which you enjoy. Although not, and this refers to an essential part, a comparable game provided by a couple of some other app company might have various other lowest wagers. This also applies to the newest payment price and the volume of gains. In such a case, merely a $5 put becomes your 100 100 percent free chances to belongings an enormous victory for the Fortunium Silver on line position.

Happy Charmer put bonus one hundred gopher silver gambling establishment position

Particular says will get prize clients over the brand new debated quantity, possibly up to 3X the safety put. All of the says limitation how much time the brand new landlord needs to return your own security put. Like most laws, certain items make a difference the amount of time allowance. Often, the newest landlord try invited more time if deductions need to be announced.

Look to see whether or not the Atm welcomes dumps, pile their costs and you may inspections, follow the prompts to enter, up coming make certain their complete. This may dictate and that points we comment and you will write about (and you may where the individuals items appear on your website), nonetheless it by no means affects our guidance otherwise information, that are rooted inside hundreds or even thousands of hours away from search. All of our lovers never spend us to be sure favorable ratings of the goods and services.

Rescue Thousands of dollars and you can Days Applying this For Your business

An excellent nonresident alien property otherwise faith having fun with Function 1040-NR need to use the Tax Price Schedule W on the Guidelines for Form 1040-NR whenever deciding the fresh income tax to your earnings effectively regarding an excellent U.S. trading otherwise organization. Generally, nonresident aliens is at the mercy of the newest 29% income tax to your terrible proceeds from gambling obtained in the Joined States if it income is not efficiently associated with a You.S. trading otherwise company and that is maybe not exempted because of the treaty. Yet not, zero income tax is actually imposed for the nonbusiness playing income a good nonresident alien victories to play blackjack, baccarat, craps, roulette, or huge-six controls in the united states. If the company is formed lower than 36 months before statement, explore its full revenues since that time it absolutely was formed.

Social Defense Benefits

Dependents which can not be advertised on the kid tax borrowing from the bank get still be considered your to the credit for other dependents. That is an excellent nonrefundable income tax borrowing from the bank away from $500 for every being qualified individual. The brand new qualifying founded need to be a good You.S. resident, U.S. federal, or You.S. resident alien. So you can allege the financing to other dependents, your dependent need a keen SSN, ITIN, or ATIN given for the otherwise until the due date of the 2024 go back (along with extensions). You could potentially claim a number of the exact same loans you to resident aliens can also be allege.

While you are the fresh beneficiary from a home otherwise trust you to definitely try involved with a trade or business in the us, you are handled to be involved with an identical exchange otherwise organization. When you’re a part from a partnership one any kind of time time inside income tax 12 months try engaged in a swap or company in america, you are considered to be involved with a trade otherwise company in the us. To the January 7, Maria Gomez try notified of a grant out of $dos,five-hundred to your spring season semester. Because the a disorder for choosing the brand new scholarship, Maria need to act as a member-time teaching secretary. Of the $dos,five-hundred grant, $step 1,100 represents percentage to possess Maria’s services.

- To locate should your pay is over $step 3,000, do not tend to be people numbers you earn from your company to possess enhances or reimbursements from team travel expenditures, if you were required to and you may did membership to your employer for those costs.

- Available for people out of IA, IL, Inside, KS, MI, MN, MO, OH otherwise WI.

- In this article, I’m going to express an informed bank offers I’m sure regarding the, both bank account also offers and checking account now offers and incentive sign upwards also offers worth taking into consideration.

Ideas on how to Contour the brand new Expatriation Income tax when you are a shielded Expatriate

It in depth analysis is founded on an intensive scoring method, targeting aspects for example precision, all round playing sense, commission structures, top-notch customer support, incentive program or other important aspects. Usually, the fresh extended the phrase, the better the rate may be. But the newest rate environment shows highest rates to your quicker words.

Utility – Have you got a disconnect notice or perhaps is your own utility bill thirty days or higher delinquent?

Go to all of our Forms and Publications look tool to own a summary of income tax forms, recommendations, and you can books, and their offered platforms. Play with the automated cell phone solution to get recorded ways to of a lot of one’s questions regarding California taxes and also to buy latest season California company entity income tax variations and you can guides. This particular service is available in English and you will Language in order to callers with touch-tone telephones. The new trustee must divulge how many the newest trust’s California citizen trustees, nonresident trustees full trustees, Ca resident noncontingent beneficiaries, and you may overall noncontingent beneficiaries. Or no of your own after the use, all the believe income try taxable in order to California.