Blogs

Definitely make certain all terms and conditions of every borrowing credit before applying. Team you to excel within category features highest department and Atm sites and you will numerous examining and you can discounts accounts, and so they earn more points for providing Cds and money industry accounts. We up coming scored for each business according to the research items and metrics one number really so you can potential prospects. You could meet the requirements having 5,one hundred thousand inside the qualifying dumps or a good 5,one hundred thousand average daily balance each month. It offers examining, offers and certification away from deposit accounts, as well as signature loans, college loans and mortgage loans.

How come One to Decrease the fresh Effect from FD Early Detachment?

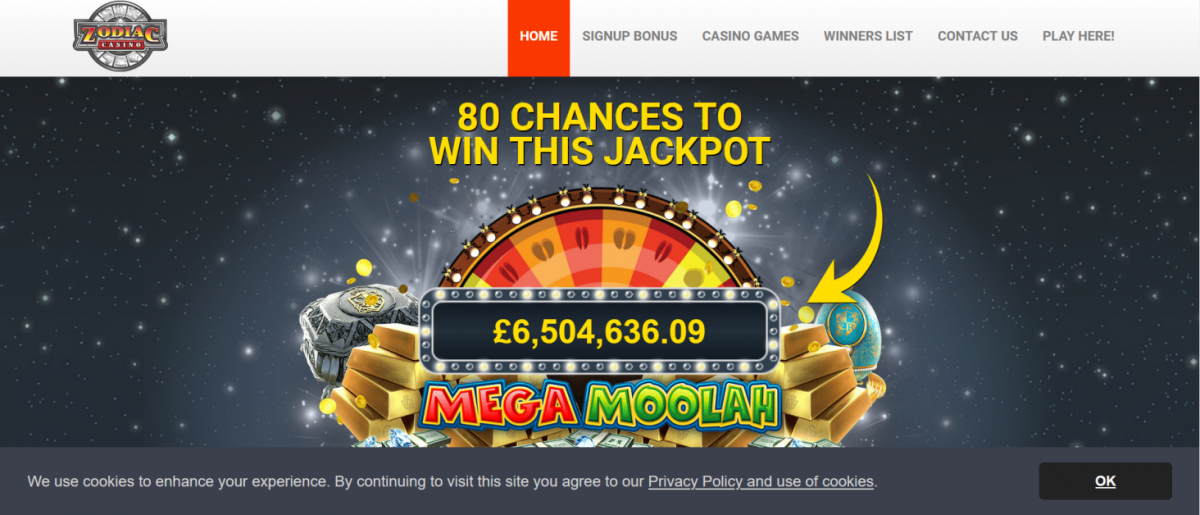

As with any gambling enterprise advertisements, no-deposit personal gambling establishment bonuses have been in a myriad of molds and you will brands and you may range between site so you can webpages. To pay off something upwards, I’ve listed a few of the most common kind of no deposit sweepstakes gives you will get encounter during the public and sweeps internet sites in the the usa lower than. Even with merely unveiling within the 2023, the working platform is really easily becoming a household name. What’smore, like most better sweepstake gambling enterprises, McLuck now offers loads of promos, therefore zero real cash purchase is actually ever before expected.

However, look at this web-site an early detachment out of an enthusiastic FD greater than ₹5 lakhs pulls a penalty of just onepercent. The credit score is dependent upon the brand new debtor’s fees background. Thus, and make a predetermined put get no lead impact on your own credit history. But not, you may also usually consume a secured credit card against the newest FD and spend your own costs on time to compliment their credit history.

- Get the current inside private money information, also provides and you will specialist info.

- Although not, on the internet banking companies will often have lengthened provider times and you may usage of pros thru cell phone, speak, otherwise email, causing them to far more flexible.

- Ally’s attention savings account doesn’t feature of a lot charge, and also the lender is actually upfront in regards to the charges it can costs.

- If you are carrying the newest purse should you choose which, it can put the bed room back to the new take rather than letting you get off.

Should i Gamble It Video slot On my Cell phone?

Examining membership need to have zero opening put conditions and get across the country offered to appear on that it number. Beyond the shortage of put and you may costs, of many examining account today have additional advantages, including money back otherwise cost management equipment. While they are rare, some 100 percent free checking account provide cashback perks.

Wire transfer costs is actually fairly well-known, however you wear’t wanted undetectable charges to have shedding less than the very least equilibrium or using away-of-circle ATMs. Comun is a more recent fintech team which provides financial products and characteristics to your underbanked. They is designed to offer a lot more comprehensive financial features to possess immigrants and you can their own families.

If you absolutely need to split a term put, you acquired’t only be able to look online and you will tick a package. Since the procedure may vary by the lender, there are what things to consider when you wish to split an expression put. Basically, even though, you could potentially withdraw particular otherwise all finance your transferred regarding the membership before label closes, so long as you proceed with the proper actions and don’t head paying a penalty.

Zero, tax rescuing fixed dumps typically have a secure-inside the age of five years and don’t allow untimely withdrawals. Repaired places (FDs) is actually a popular funding solution within the Asia using their security and you can glamorous productivity. But not, there might be instances the place you need break your FD before its maturity day.

High 5 Gambling establishment – Better Complete No deposit Sweeps Local casino

It’s rare to find an excellent debit card having a family savings, you could consult you to using this type of membership in order to more readily access their finance. As the Synchrony is an on-line lender, you’ll also have round-the-clock usage of the account from your own products. Instead of offering a separate savings account, SoFi provides a combined checking and you will checking account. They doesn’t fees a monthly solution fee otherwise normal account charges, such as overdraft, returned-items or end-payment costs. SoFi’s most other family savings provides were up to 50 in the totally free overdraft visibility on the debit credit requests (when you yourself have at the very least 1,100000 directly in deposits 30 days). The new account does not have any monthly charges and you will pays 1percent cash return to your up to 3,100 in the debit cards sales monthly.

Depending on your financial business, you happen to be capable availability your own accumulated Computer game interest instead of punishment. Some establishments makes it possible to access accrued attention instead punishment, providing you do not touch the primary. This means hearing the fresh terms and conditions to the exactly about the Cd purchases, of rates so you can punishment. What’s more, it function having fun with experienced steps, including Video game laddering, to simply help enable you to get the most from it protecting vehicle’s balances and you may interest, while maintaining particular independence.

Inside the 2012, SoFi revealed the Student loan Refinancing program to possess government and personal figuratively speaking. Now, SoFi suits more 6.9 million people and it has lengthened the device giving to add credit, paying, individual financial, insurance rates, and a lot more. Premature withdrawal of repaired deposit is a very common occurrence, have a tendency to driven by the unanticipated monetary needs.

The bank offers 100 percent free access to over 60,000 totally free Allpoint and you may MoneyPass ATMs, along with an incredibly ranked app with features such an excellent equipment one to assesses their investing. Although not, Come across doesn’t reimburse out-of-community Atm costs, and it also fees 31 to possess cord transfers. Your obtained’t getting charged by the Connexus for inside the-community or out-of-community Automatic teller machine purchases, however the proprietor out of an out-of-system Automatic teller machine you may charge you. The good news is, Connexus reimburses as much as 25 monthly within the Automatic teller machine surcharges, considering you meet up with the account’s month-to-month requirements. Connexus Borrowing from the bank Partnership doesn’t costs customers a fee for overdraft transfers away from linked membership.